Medicare Graham for Beginners

Medicare Graham for Beginners

Blog Article

Little Known Facts About Medicare Graham.

Table of ContentsThe Of Medicare GrahamMedicare Graham for BeginnersSome Known Facts About Medicare Graham.Medicare Graham for DummiesSome Known Questions About Medicare Graham.Getting My Medicare Graham To WorkMedicare Graham Can Be Fun For AnyoneMedicare Graham for Dummies

In 2024, this limit was evaluated $5,030. As soon as you and your plan invest that amount on Part D medications, you have actually entered the donut opening and will certainly pay 25% for medications moving forward. When your out-of-pocket prices reach the second limit of $8,000 in 2024, you are out of the donut opening, and "catastrophic coverage" begins.In 2025, the donut hole will certainly be mostly eliminated in support of a $2,000 restriction on out-of-pocket Component D medicine investing. Once you hit that limit, you'll pay nothing else out of pocket for the year. If you just have Medicare Parts A and B, you could think about supplemental private insurance coverage to help cover your out-of-pocket expenses such as copays, coinsurance, and deductibles.

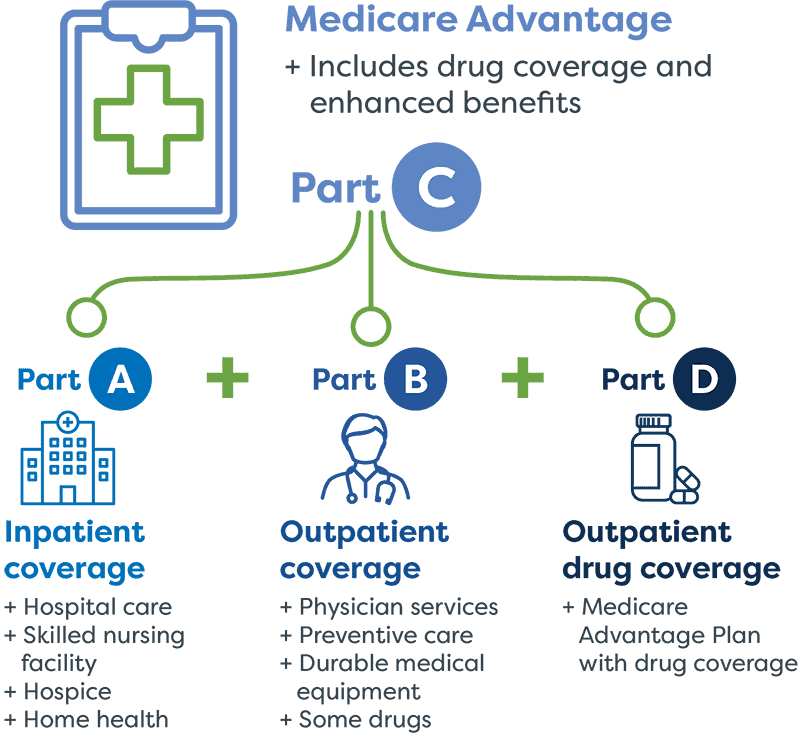

While Medicare Component C works as an option to your initial Medicare strategy, Medigap interacts with Parts A and B and aids complete any type of insurance coverage gaps. There are a few vital things to understand about Medigap. Initially, you should have Medicare Components A and B prior to getting a Medigap plan, as it is a supplement to Medicare and not a stand-alone policy.

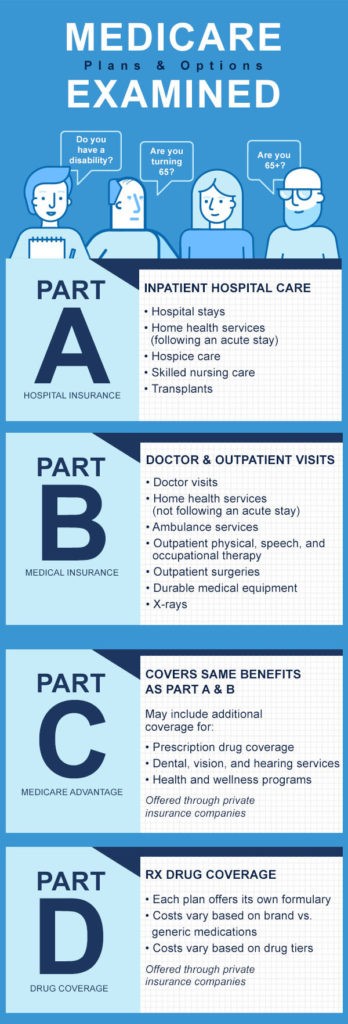

Medicare has actually progressed for many years and currently has four components. If you're age 65 or older and receive Social Safety and security, you'll instantly be enlisted in Component A, which covers a hospital stay costs. Parts B (outpatient services) and D (prescription medication advantages) are voluntary, though under certain conditions you might be automatically enlisted in either or both of these too.

The Medicare Graham Ideas

, depending on exactly how several years they or their spouse have actually paid Medicare tax obligations. Private insurance firms sell and carry out these policies, yet Medicare has to accept any type of Medicare Benefit plan before insurers can market it. Medicare does not.

typically cover Usually %of medical clinical, expenses most plans many a person to individual a fulfill before Medicare prior to for medical services.

Medigap is a single-user policy, so spouses need to acquire their very own coverage. The prices and benefits of different Medigap plans depend upon the insurance coverage firm. When it involves pricing Medigap strategies, insurance service providers might utilize among several techniques: Premiums are the same no matter of age. When a person begins the plan, the insurance copyright elements their age right into the costs.

The Best Guide To Medicare Graham

The insurance firm bases the initial premium on the individual's current age, company website but premiums rise as time passes. The price of Medigap prepares varies by state. As noted, rates are reduced when an individual gets a policy as quickly as they get to the age of Medicare eligibility. Specific insurance provider may likewise offer price cuts.

Those with a Medicare Advantage strategy are disqualified for Medigap insurance. The moment might come when a Medicare plan owner can no longer make their very own choices for reasons of mental or physical health. Before that time, the individual should mark a trusted person to act as their power of lawyer.

The individual with power of attorney can pay costs, data taxes, collect Social Safety advantages, and pick or alter health care strategies on part of the guaranteed person.

Medicare Graham Things To Know Before You Get This

Caregiving is a requiring job, and caregivers frequently invest much of their time fulfilling the demands of the individual they are caring for.

Depending on the private state's policies, this might consist of working with relatives to offer treatment. Considering that each state's guidelines differ, those looking for caregiving repayment need to look right into their state's requirements.

The Buzz on Medicare Graham

The insurance provider bases the original costs on the person's existing age, but costs increase as time passes. The rate of Medigap intends varies by state. As kept in mind, prices are lower when an individual acquires a plan as quickly as they reach the age of Medicare qualification. Specific insurer may also supply discount rates.

Those with a Medicare Advantage plan are disqualified for Medigap insurance. The time may come when a Medicare strategy holder can no more make their very own decisions for reasons of psychological or physical health. Prior to that time, the individual needs to mark a trusted individual to work as their power of attorney.

Some Known Incorrect Statements About Medicare Graham

The person with power of attorney can pay bills, documents tax obligations, accumulate Social Safety and security benefits, and choose or alter medical care plans on part of the guaranteed individual.

Caregiving is a demanding task, and caregivers usually spend much of their time meeting the demands of the individual they are caring for.

Report this page